fa chai games how to bet against a stock

2025-11-28 02:33:48 user fb777 live

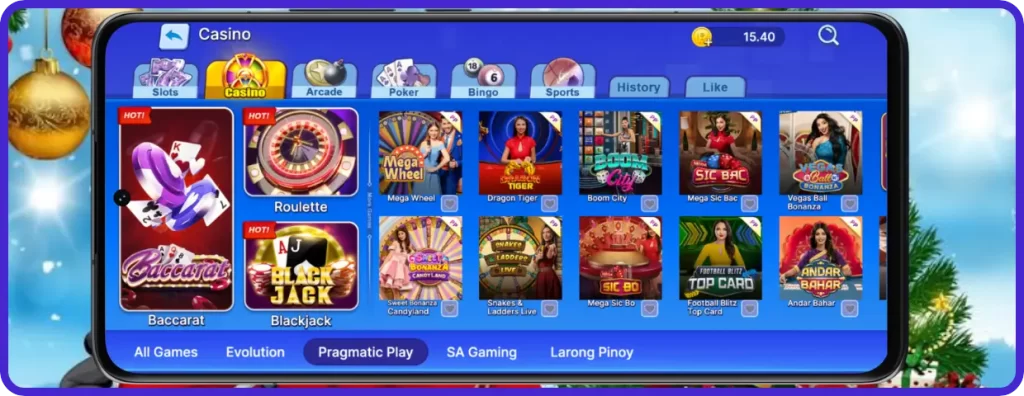

fa chai games Online Casino

Ang fa chai games ay ang Iyong Premier Online Casino para sa Pagtaya.

Ilabas ang Iyong Mga Simbuyo at Pasiglahin ang Iyong Kilig sa fa chai games!

Craving excitement? Ang fa chai games ay ang iyong one-stop shop para sa online na kasiyahan. Isa ka mang batikang gamer o usyosong bagong dating, mayroon kaming para sa lahat!

**How to Bet Against a Stock: A Comprehensive Guide

**Investing in the stock market can be a lucrative endeavor, but it isn’t without its risks. While many investors aim to profit from rising stock prices, others choose to bet against specific stocks when they believe a company’s value will decrease. This practice, known as short selling, can be an effective strategy for profiting from falling markets or individual stocks that appear overvalued or troubled. This article will explore how to bet against a stock, the mechanics of short selling, its risks, and alternative strategies for bearish positions.

### Understanding Short Selling

Short selling involves borrowing shares of a stock and selling them on the market with the expectation of buying them back later at a lower price. The profit (or loss) is realized from the difference between the initial selling price and the later repurchase price.

Here’s a step-by-step breakdown of how short selling works:

1. **Identify a Target Stock**: The first step in betting against a stock is to identify a company that you believe is overvalued or facing challenges that could lead to a decline in its stock price. This could involve thorough research, including analyzing financial statements, management decisions, market trends, and sector performance.

2. **Borrow Shares**: Once you’ve identified a stock to short, you need to borrow shares from a brokerage or another institutional investor. Short selling can only be done through a margin account, where your brokerage will assess the available shares and allow you to borrow a specific number of them.

3. **Sell the Borrowed Shares**: After borrowing the shares, you sell them on the open market at the current market price. This transaction generates cash, but since you owe the borrowed shares back, you’re in a short position.

4. **Wait for the Price to Decline**: The goal of short selling is for the stock price to decline after you’ve sold the borrowed shares. During this period, you need to monitor both the stock price and any pertinent news or developments that could affect the company’s value.

5. **Buy Back the Shares**: Once the stock price falls to a favorable level, you buy the same number of shares back to close your position. This is known as “covering” the short position. If the stock price has dropped, you’ll purchase shares at a lower price than you initially sold them for.

6. **Return the Borrowed Shares**: After buying back the shares, you return them to the lender. Your profit (or loss) is the difference between the selling and buying price, minus any interest or fees associated with borrowing the shares.

### Risks of Short Selling

While short selling can be profitable, it carries significant risks.

– **Unlimited Loss Potential**: When you buy a stock, your potential loss is limited to the amount you invested. However, when you short a stock, there is no upper limit to how high the stock price can go. If the price increases instead of decreasing, you could face substantial losses.

– **Margin Requirements**: Short selling is typically conducted in a margin account, meaning you borrow money from the brokerage to leverage your position. If the stock price rises and your position goes against you, your broker may issue a margin call, requiring you to deposit additional funds or close your position at a loss.

– **Short Squeeze**: If a heavily shorted stock experiences positive news or a rally, it can lead to a short squeeze. In this scenario, many short sellers rush to cover their positions, driving the stock price even higher and exacerbating losses for those still in a short position.

### Strategies to Mitigate Risks

1. **Use Stop-Loss Orders**: A stop-loss order allows investors to set a maximum loss threshold where the broker automatically closes the position if the stock reaches a certain price. This can help limit potential losses.

2. **Position Sizing**: Limit the amount of capital you allocate to short positions. Using a smaller percentage of your portfolio can minimize risk exposure.

3. **Time your trade**: Be wary of placing short bets before significant market events such as earnings reports or major product launches, which can lead to unexpected price movements.

4. **Diversify**: Instead of overly concentrating your bets against one stock, consider shorting multiple stocks across different sectors or using instruments like ETFs to spread the risk.

### Alternative Ways to Bet Against a Stock

If you’re hesitant to short sell stocks directly due to the associated risks, there are alternative methods:

– **Put Options**: Buying put options gives you the right, but not the obligation, to sell a stock at a predetermined price within a certain timeframe. If the stock price falls, the value of the put option typically increases, allowing you to profit without the risks of margin calls and unlimited losses.

– **Inverse ETFs**: These are exchange-traded funds designed to deliver the opposite performance of an index or sector. Buying shares of inverse ETFs can provide a more manageable way to bet against an entire index or sector without the need for short selling.

– **Sector Rotation**: By shifting your investments from sectors or industries that are underperforming to those that are expected to prosper, you can mitigate or profit from anticipated downturns without specifically shorting stocks.

### Conclusion

Betting against a stock through short selling can be a profitable strategy for seasoned investors willing to undertake the risks involved. It requires diligent research, an understanding of market dynamics, and the capacity to manage the emotional and financial risks inherent in wagered declines. Alternatively, options and ETFs allow investors to position themselves negatively without the complexities of short selling. Whatever method you choose, ensure it aligns with your risk tolerance, investment goals, and overall strategy in the dynamic world of the stock market. It is essential to stay informed and to continuously reassess your positions in the ever-evolving markets.

Conclusion

fa chai games how to bet against a stock is the one-stop location for sports betting, live casino games, and amazing online slots. We offer betting safe and enjoyable for everyone by providing simple navigation, exciting promotions, and responsible gaming. On our platform, security and equality offer a safe, exciting, and rewarding betting experience. We invite you to join fa chai games how to bet against a stock and have an unforgettable experience with our special casino games and online slots. Every wager matter at fa chai games how to bet against a stock, and the excitement has no limits. Let’s make each match unforgettable.